Article and graphics provided courtesy of AWA Alexander Watson Associates

Labeling and product decoration is a complex market given the ever-changing nature of the product packaging industry.

International market research company AWA Alexander Watson Associates devotes a significant amount of time and resources to this market, producing an annual global update aimed at keeping industry participants at all levels of the supply chain informed of the latest market trends and data.

International market research company AWA Alexander Watson Associates devotes a significant amount of time and resources to this market, producing an annual global update aimed at keeping industry participants at all levels of the supply chain informed of the latest market trends and data.

AWA Labeling & Product Decoration Annual Review 2021 provides an overview of the global and regional label markets. The review provides the current status of key aspects of the industry, including global volumes; market structures; market characteristics by region; and growth rates. Raw material trends and M&A activity also are assessed. The report is a practical tool for producers, material suppliers and all companies involved in the value chain. The following is a summary of world label volumes for 2021.

AWA Labeling & Product Decoration Annual Review 2021 provides an overview of the global and regional label markets. The review provides the current status of key aspects of the industry, including global volumes; market structures; market characteristics by region; and growth rates. Raw material trends and M&A activity also are assessed. The report is a practical tool for producers, material suppliers and all companies involved in the value chain. The following is a summary of world label volumes for 2021.

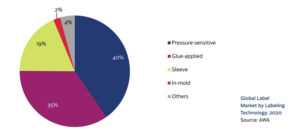

Pressure-sensitive labels

Pressure-sensitive labels offer features that make them almost uniquely suited to variable information printed (VIP) label applications. Consequently, VIP labels account for approximately 48% of the total pressure-sensitive label volume. Removing this volume and looking at just the primary application, a shift is witnessed in the market shares of the different labeling technologies and, at the same time, a more balanced view of the market space in which these technologies compete is offered. More details can be found in the separate regional sections.

COVID-19 impact

The global volume growth for label products in 2020 is estimated at 3.3%. This reflects a pickup in the global growth rate compared to 2019. Historically, there has been a strong relationship between global label market growth and global GDP growth.

However, with COVID-19, the label industry did not experience the same economic effect due to the global pandemic. Instead, the COVID-19 situation demonstrated the significant role the label industry plays in the worldwide manufacturing and supply chain.

E-commerce and global growth

Global growth is expected to continue at a similar rate, with a CAGR% of 3.4% in the period 2020-2023. This is primarily driven by high demand for VIP labels, due to increased transport/logistics and e-commerce activity.

E-commerce experienced a huge boost in regions such as Europe and North America during the initial lock-down. It is expected this segment will continue growing even once restrictions are lifted, as the consumer base driving this growth will continue to use e-commerce/online shopping primarily due to its convenience.

There also are increased levels of competition between label formats and alternative packaging styles – notably cans for beverages and flexible packaging for foods.

Growth of Asian markets

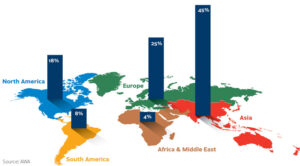

Growth in label demand showed variations, both by regional markets and by label format.

In early 2020, the market experienced the impact of COVID-19 evolving from an Asia-focused supply chain shock to a genuinely global stoppage in normal business activity – the outage to Chinese production rippled across Asian supply chains. Although China, the biggest label market within Asia, already can be seen to be recovering and returning to positive GDP growth.

Similarly, other advanced economies in Asia also managed to contain the outbreak more successfully and also are likely to recover quickly with the vaccine roll-out.

Hence, Asia continues to drive the growth – despite being lower than historical growth rate, Asia’s growth rate still is higher than the other regional growth rates.

Consequently, Asia continues to gain an increasing share of the global label market, with an estimated growth rate of 4.0% in 2020, driven by the fast recovery growth in the Chinese markets.

European and North American markets

Within the established markets, both Europe and North America experienced a positive growth – 2.8% and 3.0% respectively in 2020. There was immense pressure on the overall packaging and supply chain sector as the sales of staple food, health and personal care, and household chemicals surged both online and offline.

This had a positive impact on the primary product application, where all the labeling technology largely compete, especially in the second quarter of 2020, and is expected to stabilize at a slightly lower rate, although still higher than 2019.

AWA forecasts Europe and North America will continue growing at a CAGR% of 2.1% and 2.5% respectively between 2020-2023.

South American market

Overall, South American label demand remains consistent in 2020. Forward forecasts for label market growth rate continue to predict a positive outlook for growth in this emerging regional market for labels at 1.6% in the period 2020-2023.

AWA Alexander Watson Associates is a global business-to-business market research, publishing, events and advisory services company with a unique focus on the specialty packaging, coating and converting industries. For more information or to access the full report, visit www.awa-bv.com.

The 2020 AWA Annual Review also includes an analysis of the impact of COVID-19. To access the full review, visit www.awa-bv.com.

The 2020 AWA Annual Review also includes an analysis of the impact of COVID-19. To access the full review, visit www.awa-bv.com.