By Jennifer Heathcote, vice president, Business Development, GEW (EC) Limited

On March 6, 2024, the US Securities and Exchange Commission (SEC) voted 3–2 to adopt The Enhancement and Standardization of Climate-Related Disclosures for Investors. The rule requires all entities registered with the SEC to disclose climate-related information. It was proposed in March 2022 and was meant to be published in the Federal Register following a legally required public comment period. After receiving more than 24,000 comments, 4,500 letters and various litigation threats from those concerned with the rule’s impact on businesses and the economy, as well as the difficulty in directly connecting weather-related business risk to climate change, the SEC softened the rule and delayed adoption by two years. The final 886-page rule ultimately was published in the Federal Register on March 28, 2024. Compliance will be phased in between 2025 and 2033. The rule in its entirety can be downloaded from the SEC website. 1,2

On March 6, 2024, the same day the rule was adopted, lawsuits challenging the SEC’s authority to mandate regulations not previously approved by Congress were filed in the US courts by 25 states, companies and business groups arguing the SEC overreached. Others, such as the Sierra Club and Natural Resources Defense Council, insisted the SEC should have done more. On March 15, 2024, the 5th Circuit Court of Appeals granted an administrative stay on the rule and, on March 21, a US judicial panel consolidated at least nine of the lawsuits into a single case to be heard by the randomly selected St. Louis-based 8th Circuit Court of Appeals. Pending the court’s ruling, implementation and enforcement of the SEC’s Climate-Related Disclosures rule temporarily is paused. The 8th Circuit ultimately will decide the constitutionality of the rule and whether it can proceed. 3

The SEC is an independent agency of the US Federal government. According to its website, www.sec.gov, the SEC protects investors, promotes fairness in the securities markets, and shares information about companies and investment professionals to help investors make informed decisions and invest with confidence. The purpose of the SEC’s Climate-Related Disclosures rule is to provide transparency to investors regarding potential climate-related risks to publicly traded companies, strategies those companies are pursuing to mitigate climate-related risks and foreseeable losses due to extreme weather events. The Climate-Related Disclosures rule applies to medium and large, foreign and domestic, publicly traded companies listed on US exchanges and all companies pursuing an initial public offering (IPO). Any company not legally required to register with the SEC is under no obligation to comply with the rule. The SEC estimates that approximately 2,800 companies will be impacted by the rule should it proceed as written. 4

Readers are encouraged to consult other resources, professional advisors and the rule directly for a full understanding of what registrants are required to disclose in financial statements. An SEC fact sheet 5 summarized the disclosures as:

- climate-related risks and their actual or likely material impacts on the registrant’s business, strategy and outlook;

- registrant’s governance of climate-related risks and relevant risk management processes;

- registrant’s greenhouse gas (“GHG”) emissions, which, for accelerated and large accelerated filers and with respect to certain emissions, would be subject to assurance;

- certain climate-related financial statement metrics and related disclosures in a note to its audited financial statements; and

- information about climate-related targets and goals, and transition plan, if any.

One notable change the SEC made to the final rule was the elimination of Scope 3 greenhouse gas (GHG) emissions reporting. Reporting of Scope 1 and Scope 2 emissions remains intact but is waved for Smaller Reporting Companies (SRCs) and Emerging Growth Companies (EGCs). Scope 4 is not addressed.

The purpose of this article is to provide relevant context that led to the SEC rule and explain scope emissions. The article also draws a connection between increasing interest and use of UV curing – and more specifically UV LED curing – to set inks, coatings, adhesives and extrusions across a wide range of printing, coating and converting markets, and the need for companies to reduce scope emissions in manufacturing processes.

Greenhouse Gas (GHG) Emissions

Emissions refer to gases that are released directly into the air. Emissions originate from both natural sources as well as anthropogenic equipment and processes used in electricity generation, transportation, industrial facilities, commercial and residential buildings, agriculture, land use (including mining and energy drilling) and forestry. Some emissions have little to no impact on the environment, human health or climate. Others contain some combination of undesirable and potentially harmful greenhouse gases (GHGs), volatile organic compounds (VOCs), hazardous air pollutants (HAPs) and toxic air pollutants (TAPs).

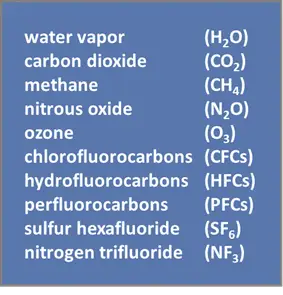

While carbon dioxide gets the most attention, GHGs include multiple different gases in the lowest level of the atmosphere known as the troposphere (Figure 1). GHGs absorb outgoing infrared radiation from the earth’s surface and trap the radiated energy as heat in the troposphere.

Non-Governmental Organizations (NGOs)

Before digging into global climate-change policy, one first should understand non-governmental organizations (NGOs). The United Nations (UN) established NGOs in Chapter 10, Article 71 of its 1945 Charter. The premise was that the UN would approve citizen organizations for the purpose of providing consultative services directly to the UN. NGOs are meant to be independent and are designated by the UN with General, Special or Roster status. 6 They are neither a government entity nor a UN member state and operate under a mission statement that champions social, political or economic causes that align with overall UN objectives. While NGOs are not for profit, many function with annual budgets in the millions and even billions of dollars. They are funded through donations, grants, contracts, the United Nations, member nations and fundraising.

In its inaugural year, the UN granted 41 NGOs with consultative status. On December 31, 2022, there were 6,343 officially sanctioned NGOs. The full list can be downloaded from the UN website. 7 Many NGOs participate fully and directly in UN policy creation and decision-making. Over the years, the term NGO has been expanded to mean any non-profit organization. GlobalGiving Atlas (www.globalgiving.org/atlas/) provides a comprehensive listing of over 9.6 million non-profits, charities and NGOs. Only NGOs that apply and are granted status by the UN are able to participate in UN policy making.

Role of the United Nations in Driving Climate-Change Regulatory Policy

Beginning in the late 1970s and continuing to the present day, the UN through its conferences, commissions, policy papers, international treaties, global projects and affiliated NGOs made sustainability a legislative priority for member nations. Gradually, the UN became the foremost global policy maker regarding sustainability and sustainable development and the driver of global mandates meant to address climate change. In doing so, the UN positioned itself as the arbiter on what is and is not sustainable and which anthropogenic activities are deemed favorable or detrimental to the world’s climate.

Through policy making, global projects and a growing administrative stage, the UN and activist NGOs have a direct impact on how individuals, businesses and governments throughout the world operate on a day-to-day basis with rules and mandates specifically enacted for the purpose of achieving sustainability and climate change targets championed by the UN.

What Led to the SEC Climate-Related Disclosures Rule?

In December of 1997, a UN hosted event oversaw the adoption of the Kyoto Protocol, which requires countries to reduce emissions of six greenhouse gases in an effort to slow climate change. The Kyoto Protocol is an international treaty signed by 192 countries. It was developed between 1993 and 1997 with the participation of 187 NGOs.

In 1997, two NGOs, the World Resources Institute (WRI) and the World Business Council for Sustainable Development (WBCSD), partnered to develop the Greenhouse Gas Protocol. It was published in 2004. The purpose of the protocol was to establish a standardized global method of GHG accounting. The 2004 protocol defined Scope 1 and Scope 2 emissions and provided guidance on how emissions should be measured and reported. In 2011, the protocol added Scope 3 and, in 2017, Scope 4 was introduced. Scope emissions are explained in the next section.

In the United States, per the US Constitution, international treaties have negligible domestic impact unless ratified by a two-third majority vote in the Senate. During recent decades, however, the precedent has been established where international treaties are legally recognized even without ratification if signed by the President. In lieu of a signed treaty, desirable aspects can be carved out and passed as local, state or congressional legislation. Congress also can grant rule-making authority to a subset agency of the government, such as the Environmental Protection Agency (EPA) or the Securities and Exchange Commission (SEC), among others. These agencies often will exert their own authority without congressional approval, as is the case with the SEC’s Climate-Related Disclosures Rule.

In 2005, UN Secretary-General Kofi Annan formed a 70-person group from 12 different countries to develop principles for responsible investment. Principles for Responsible Investment (PRI, www.unpri.org 8) subsequently was registered as an NGO and granted UN consultative status. PRI is supported by the UN but is not part of the UN’s organizational structure. In 2006, PRI published a policy document by the same name and launched its initiative at the New York Stock Exchange. 8

The PRI promotes six key investment principles, known as The Principles, and recommends actions for incorporating Environmental, Social, Governance (ESG) issues into investment practices and financial evaluations (Figure 2). PRI was the first UN-driven policy document to reference ESG. A company’s ESG score is calculated by independent, third-party analysts, with a maximum obtainable score of 100. ESG scores are used by institutional investors to evaluate and compare business entities and countries when making investment decisions.

Institutional investment companies are encouraged to become a signatory to the PRI as a way to publicly demonstrate commitment to responsible investment and place it at the heart of a global community seeking to build a more sustainable financial system. 9 Over 5,000 institutional investment companies are signatories, including Blackrock, State Street, Vanguard, Fidelity and JP Morgan Chase.

A 2019 Harvard Business Review article noted that one or the other of Blackrock, Vanguard or State Street is the largest shareholder in 88% of S&P 500 companies, and institutional investors overall own 80% of all stock in the S&P 500. 10 As a result, institutional investors through proxy voting and influence are integrating ESG principles into the strategies of publicly traded companies and have been doing so since they became signatories of the PRI.

As more institutional investors became signatories to the PRI, they began petitioning regulators for standards that would better enable them to abide by PRI guidelines. In response, the UK Parliament created Streamlined Energy and Carbon Reporting (SECR) in 2018, with additional guidance provided in 2019. 11 SECR requires Scope 1 and 2 reporting in annual reports for publicly traded as well as large private companies. Scope 3 is voluntary. The SECR impacts approximately 11,900 companies. In turn, the EU implemented the broader Corporate Sustainability Reporting Directive (CSRD) in 2021. 12 CSRD requires Scope 1, 2 and 3 reporting and impacts over 50,000 companies.

In the US, the Securities and Exchange Commission published a rule entitled Enhancement and Standardization of Climate-Related Disclosures for Investors to the Federal Register on March 28, 2024. The final rules reflect the Commission’s efforts to respond to investors’ demand for more consistent, comparable and reliable information about the financial effects of climate-related risks on a registrant’s operations and how it manages those risks while balancing concerns about mitigating the associated costs of the rules. 1 The SEC rule requires large, publicly traded companies to report Scope 1 and 2 emissions and is anticipated to impact 2,800 companies. The rule currently is being reviewed by the 8th Circuit Court and is paused until a ruling on its constitutionality is made.

Part 2 will be published in the October/November issue of Plastics Decorating and will cover scope emissions and how lower emissions in industrial processes.

Republished with premission from UV+EB Technology (www.uvebtech.com)

References

- US Securities and Exchange Commission. (2024, March 6). SEC Adopts Rules to Enhance and Standardize Climate-Related Disclosures for Investors. www.sec.gov/news/press-release/2024-31

- The Enhancement and Standardization of Climate-Related Disclosures for Investors AGENCY: Securities and Exchange Commission. 17 CFR 210, 229, 230, 232, 239, and 249. [Release Nos. 33-11275; 34-99678; File No. S7-10-22] RIN 3235-AM87. March 28, 2024. www.sec.gov/rules/2022/03/enhancement-and-standardization-climate-related-disclosures-investors

- Mindock, Clark. (2024, March 22). Challenges to SEC’s climate rules sent to conservative-leaning US appeals court. Reuters. www.reuters.com/legal/challenges-secs-climate-rules-sent-conservative-leaning-us-appeals-court-2024-03-21/#:~:text=March%2021%20(Reuters)%20%2D%20A,states%20and%20a%20business%20group

- Athrappully, Naveen. (April 6, 2024). SEC Forced to Halt Climate Reporting Mandate for Businesses. The Epoch Times. www.theepochtimes.com/business/sec-forced-to-halt-climate-reporting-mandate-for-businesses-5623236

- US Securities and Exchange Commission. (March 2024). FACT SHEET. The Enhancement and Standardization of Climate-Related Disclosures: Final Rules. www.sec.gov/news/press-release/2024-31

- United Nations Economic and Social Council. Introduction to ECOSOC Consultative Status. https://ecosoc.un.org/en/ngo/consultative-status

- United Nations. E/2023/INF/5. www.undocs.org/Home/Mobile?FinalSymbol=E%2F2023%2FINF%2F5&Language=E&DeviceType=Desktop&LangRequested=False

- PRI Association. (2006). An introduction to the Principles for Responsible Investment.

- Principles for Responsible Investing. Signatories Page. https://www.unpri.org/signatories

- Greenspon, Jacob. (February 22, 2019). How Big a Problem Is It That a Few Shareholders Own Stock in So Many Competing Companies? Harvard Business Review. https://hbr.org/2019/02/how-big-a-problem-is-it-that-a-few-shareholders-own-stock-in-so-many-competing-companies

- Guidance. Streamlined Energy and Carbon Reporting (SECR) for academy trusts. (Updated 14 February 2024). www.gov.uk/government/publications/academy-trust-financial-management-good-practice-guides/streamlined-energy-and-carbon-reporting

- European Commission. (2022). Corporate Sustainability Reporting Directive (CSRD). Directive (EU) 2022/2464 of the European Parliament and of the Council of 14 December 2022 amending Regulation (EU) No 537/2014, Directive 2004/109/EC, Directive 2006/43/EC and Directive 2013/34/EU, as regards corporate sustainability reporting. https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=CELEX:32022L2464

- Mills, Mark. How Much Energy Will the World Need? Praeger University Video. www.prageru.com/video/how-much-energy-will-the-world-need

- OurWorld in Data. Fossil Fuels. www.ourworldindata.org/fossil-fuels#:~:text=Globally%2C%20fossil%20fuels%20account%20for,summed%20together)%20across%20the%20world